DAOs for US Startups 2025: 6-Step Blueprint & Practical Solutions

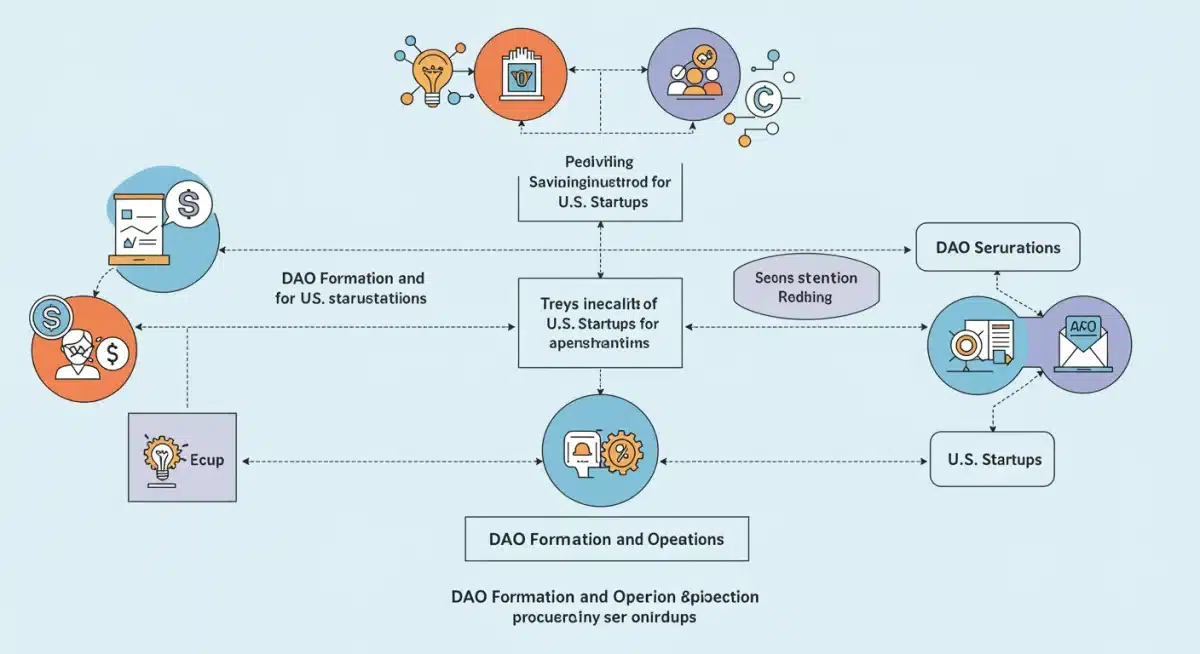

U.S. startups seeking to launch Decentralized Autonomous Organizations (DAOs) in 2025 require a strategic 6-step blueprint for success, integrating practical solutions and insider knowledge to navigate complex regulatory landscapes and technological advancements.

Decentralized Autonomous Organizations (DAOs): A 6-Step Blueprint for U.S. Startups in 2025 (PRACTICAL SOLUTIONS, INSIDER KNOWLEDGE) is fast becoming a pivotal topic for innovators and entrepreneurs. As the digital frontier expands, understanding how to effectively establish and operate a DAO is no longer optional but essential for competitive advantage in the U.S. market.

Understanding the DAO Landscape for U.S. Startups in 2025

The concept of Decentralized Autonomous Organizations (DAOs) continues to evolve rapidly, particularly within the U.S. regulatory and technological environment. For startups eyeing 2025, grasping the foundational principles and the current state of play is the critical first step. DAOs represent a paradigm shift in organizational structure, leveraging blockchain technology to enable transparent, community-driven governance without traditional hierarchical management.

In the U.S., the legal and operational frameworks for DAOs are still nascent but developing. States like Wyoming and Vermont have taken proactive steps to provide legal recognition, offering templates that other jurisdictions may follow. This fragmented legal landscape necessitates a careful approach, understanding that a DAO’s legal status can significantly impact its operational viability and the liabilities of its participants. Startups must consider how their chosen structure aligns with existing and anticipated regulations, ensuring compliance from inception.

Key Characteristics of Modern DAOs

- Decentralized Governance: Decisions are made by token holders through voting mechanisms, not a central authority.

- Transparency: All transactions and governance actions are recorded on a blockchain, making them publicly verifiable.

- Community-Driven: Members actively participate in shaping the organization’s future, from treasury management to protocol upgrades.

- Programmable Rules: Operational rules are encoded in smart contracts, automatically executing decisions once voting thresholds are met.

The allure of DAOs for U.S. startups lies in their potential to foster unparalleled community engagement, reduce operational overhead, and create highly resilient, censorship-resistant organizations. However, this potential is coupled with unique challenges, including legal ambiguities, security risks associated with smart contracts, and the complexities of achieving true decentralization. Navigating this landscape requires both technical acumen and a deep understanding of the evolving regulatory environment.

Step 1: Defining Your DAO’s Purpose and Governance Model

The inception of any successful DAO begins with a clear, compelling purpose. For U.S. startups in 2025, this means articulating a mission that resonates with potential members and aligns with the decentralized ethos. A well-defined purpose will guide all subsequent decisions, from smart contract design to community building. Without a clear objective, a DAO risks becoming rudderless, failing to attract and retain the talent and capital necessary for its survival.

Once the purpose is established, the next crucial element is designing the governance model. This is perhaps the most critical aspect of a DAO, as it dictates how decisions are made, how resources are allocated, and how conflicts are resolved. Various governance models exist, each with its own advantages and disadvantages. U.S. startups must choose a model that best suits their mission, community size, and desired level of decentralization. This choice has profound implications for the DAO’s efficiency, security, and long-term sustainability.

Common Governance Models to Consider

- Token-Weighted Voting: The most prevalent model, where voting power is proportional to the number of tokens held.

- Quadratic Voting: Aims to reduce the influence of large token holders by making additional votes progressively more expensive.

- Delegated Proof of Stake (DPoS): Token holders elect delegates to vote on their behalf, balancing decentralization with efficiency.

- Multi-Signature Wallets: Requires multiple key holders to sign off on transactions, often used for treasury management.

Selecting the right governance model involves a delicate balance between efficiency and decentralization. A model that is too cumbersome can lead to decision paralysis, while one that is too centralized undermines the very principle of a DAO. Startups should also consider mechanisms for proposal submission, discussion, and execution. Effective communication channels and transparent processes are vital for fostering an engaged and informed community. This foundational step sets the stage for the entire DAO’s operation, making informed choices here paramount.

Step 2: Legal and Regulatory Compliance in the U.S.

Navigating the complex legal and regulatory landscape is arguably the most challenging aspect for DAO US Startups 2025. Unlike traditional corporations, DAOs operate in a legal gray area in many jurisdictions, including parts of the United States. While some states have begun to offer legal frameworks, a comprehensive federal approach is still pending. This necessitates a proactive and diligent approach to compliance, often requiring legal counsel specializing in blockchain and digital assets.

Startups must determine the legal entity structure, if any, that best fits their DAO. Options range from establishing a foundation in a crypto-friendly jurisdiction to registering as a limited liability company (LLC) in states like Wyoming, which now offers specific legal recognition for DAOs. The choice of legal wrapper can significantly impact liability for participants, tax obligations, and the ability to interact with traditional financial systems. It is crucial to understand the implications of each option and how it aligns with the DAO’s long-term goals and risk tolerance.

Key Regulatory Considerations

- Securities Laws: Many DAO tokens could be classified as securities, subjecting them to stringent SEC regulations.

- Taxation: DAOs and their participants face complex tax implications, depending on their structure and activities.

- Anti-Money Laundering (AML) / Know Your Customer (KYC): Depending on their operations, DAOs may be subject to AML/KYC requirements.

- Consumer Protection: DAOs interacting with consumers must adhere to relevant consumer protection laws.

The regulatory environment is dynamic, with new guidance and enforcement actions emerging regularly. U.S. startups must stay abreast of these changes and be prepared to adapt their legal and operational strategies accordingly. Engaging with legal experts early in the process can help mitigate risks and ensure that the DAO is structured in a way that minimizes exposure to potential legal challenges. Compliance is not a one-time event but an ongoing commitment requiring continuous monitoring and adjustment.

Step 3: Developing Smart Contracts and Technical Infrastructure

The technical backbone of any DAO is its smart contracts. These self-executing contracts, stored on a blockchain, automate governance processes, treasury management, and other core functions. For U.S. startups, developing robust, secure, and efficient smart contracts is non-negotiable. The integrity of the DAO hinges on the reliability of its code; any vulnerabilities can lead to significant financial losses or a complete collapse of the organization.

The choice of blockchain platform is a primary technical decision. Ethereum remains the dominant platform for DAOs, offering a mature ecosystem and extensive developer tools. However, other blockchains like Solana, Polygon, and Arbitrum are gaining traction, providing faster transaction speeds and lower fees. Startups must evaluate platforms based on scalability, security, cost, and community support, aligning their choice with the DAO’s specific needs and technical requirements.

Essential Smart Contract Components

- Governance Contracts: Define voting mechanisms, proposal submission, and execution logic.

- Treasury Contracts: Manage the DAO’s funds, including multi-signature approvals for spending.

- Token Contracts: Define the utility or governance token, including issuance, transferability, and supply.

- Upgradeability Mechanisms: Allow for future modifications to the DAO’s smart contracts without a hard fork.

Beyond smart contracts, U.S. startups need to consider the broader technical infrastructure. This includes tools for proposal creation and discussion (e.g., Snapshot, Discourse), decentralized storage solutions (e.g., IPFS), and user interfaces for interacting with the DAO (e.g., custom dApps). Security audits by reputable third parties are paramount before deploying any smart contracts to a mainnet. These audits identify and rectify vulnerabilities, protecting the DAO and its members from potential exploits. A meticulous technical development process ensures the DAO can operate securely and efficiently.

Step 4: Tokenomics Design and Distribution Strategy

Tokenomics, the economic model governing a DAO’s native token, is fundamental to its success and sustainability. For U.S. startups in 2025, a well-designed tokenomics model incentivizes participation, aligns interests, and provides a mechanism for value capture within the ecosystem. The utility and value of the DAO’s token directly influence its ability to attract and retain a vibrant community, making this step critical for long-term growth.

The distribution strategy for the DAO’s token is equally important. How tokens are initially allocated can significantly impact decentralization and governance power. Fair and transparent distribution mechanisms are essential for avoiding excessive concentration of power, which can undermine the DAO’s decentralized ethos. Startups must consider various distribution methods, such as airdrops, liquidity mining, public sales, and allocations to core contributors and treasuries, ensuring they comply with U.S. securities regulations.

Key Elements of Tokenomics

- Token Utility: What functions does the token serve within the DAO (governance, staking, access)?

- Supply and Inflation/Deflation: Total token supply, emission schedule, and burning mechanisms.

- Incentive Mechanisms: How are users and contributors rewarded for their participation?

- Value Accrual: How does the token capture value from the DAO’s activities or ecosystem?

Designing effective tokenomics requires a deep understanding of game theory, economics, and user behavior. It’s not merely about creating a digital asset but about engineering a self-sustaining ecosystem. Startups should model various scenarios to test the resilience of their tokenomics under different market conditions and user engagement levels. Transparent communication about the tokenomics and distribution plan builds trust within the community and attracts informed participants. A robust tokenomics model is the financial engine that drives a DAO forward.

Step 5: Community Building and Engagement

A DAO is, at its core, a community. For U.S. startups launching DAOs in 2025, cultivating a strong, engaged, and active community is paramount for realizing the full potential of decentralization. Without a dedicated community, even the most technically sound DAO with perfect tokenomics will struggle to thrive. Community building is an ongoing process that requires consistent effort, transparent communication, and genuine interaction.

Engagement strategies should focus on empowering members to contribute meaningfully to the DAO’s mission. This includes establishing clear communication channels (e.g., Discord, Telegram, forums), providing educational resources about the DAO’s purpose and governance, and creating opportunities for members to propose ideas, cast votes, and participate in working groups. Recognizing and rewarding active contributors can further strengthen community bonds and incentivize sustained involvement.

Strategies for Effective Community Engagement

- Transparent Communication: Regularly share updates, financial reports, and governance discussions.

- Educational Resources: Provide guides and tutorials on how to participate in governance and use DAO tools.

- Incentivize Participation: Offer rewards for active governance participation, content creation, or development.

- Delegation and Sub-DAOs: Empower smaller groups to manage specific tasks or initiatives, fostering leadership.

Building a diverse and inclusive community is also crucial. A variety of perspectives leads to more robust decision-making and a more resilient organization. U.S. startups should actively seek out members from different backgrounds and skill sets, fostering an environment where all voices feel heard and valued. The success of a DAO is ultimately a reflection of its community’s strength and collective commitment to its shared vision.

Step 6: Iteration, Adaptability, and Long-Term Sustainability

The journey of a DAO, especially for U.S. startups in the rapidly evolving Web3 space, is one of continuous learning and adaptation. The blueprint outlined provides a solid foundation, but the real test lies in the DAO’s ability to iterate, respond to challenges, and ensure its long-term sustainability. The decentralized nature of DAOs means that adaptability must be ingrained in their operational DNA, allowing them to evolve with technological advancements, regulatory changes, and community needs.

Regular review of governance mechanisms, smart contract performance, and tokenomics is essential. As the DAO matures, its initial structures may become less efficient or sufficient. Implementing mechanisms for protocol upgrades and governance model adjustments through community consensus is vital. This iterative approach ensures that the DAO remains agile and relevant in a dynamic environment, preventing stagnation and fostering innovation from within its own ranks.

Pillars of Long-Term DAO Sustainability

- Financial Prudence: Effective treasury management and diversification of assets to ensure longevity.

- Risk Management: Proactive identification and mitigation of technical, legal, and operational risks.

- Ecosystem Development: Fostering partnerships and integrations that expand the DAO’s reach and utility.

- Continuous Innovation: Encouraging research, development, and the implementation of new ideas.

For U.S. startups, demonstrating long-term viability is not only crucial for community trust but also for attracting institutional investment and navigating regulatory scrutiny. A sustainable DAO is one that can generate value, manage its resources effectively, and maintain a robust and engaged community over time. By embracing iteration and adaptability, DAOs can transcend their initial blueprints and become enduring forces in the decentralized future.

Key Aspect |

Description for U.S. Startups > |

|---|---|

Purpose & Governance |

Define clear mission and select a suitable governance model for decentralized decision-making. |

Legal Compliance |

Navigate U.S. regulations, considering legal wrappers and compliance with securities and tax laws. |

Smart Contracts |

Develop secure, audited smart contracts on a chosen blockchain, forming the DAO’s technical backbone. |

Community & Iteration |

Build an engaged community and ensure continuous adaptation for long-term sustainability. |

Frequently Asked Questions About DAOs for U.S. Startups

The primary legal challenge remains navigating the evolving regulatory landscape, particularly concerning token classification under securities laws and determining appropriate legal entity structures to mitigate liability for participants. State-level recognition offers some clarity, but federal guidance is still developing.

Ensuring smart contract security involves rigorous testing, comprehensive audits by reputable third-party firms, and implementing best practices in coding. Regular monitoring post-deployment and establishing clear upgrade paths are also critical to address potential vulnerabilities that may emerge.

Tokenomics is crucial as it designs the economic incentives that drive participation, governance, and value accrual within the DAO. A well-crafted tokenomics model aligns the interests of all stakeholders, promoting sustained engagement and the long-term health of the decentralized organization.

Absolutely. A DAO is fundamentally a community-driven entity. Without an active and engaged community, decision-making can stagnate, and the DAO may fail to achieve its objectives. Strong community building fosters participation, innovation, and resilience, which are vital for a DAO’s long-term success.

DAOs maintain adaptability through built-in upgrade mechanisms in their smart contracts and a culture of continuous iteration. This allows the community to collectively vote on and implement changes to governance models, protocols, and strategies in response to technological shifts or regulatory developments.

What this means

The imperative for U.S. startups to strategically approach DAO US Startups 2025 is clearer than ever. This blueprint underscores that success hinges on meticulous planning, robust technical execution, and keen awareness of the evolving regulatory landscape. Businesses that embrace these principles are poised to not only navigate but also lead in the decentralized future, shaping new paradigms of organizational structure and collective value creation.